When you’re trying to make a decision about a mortgage, there are plenty of tools at your disposal. Whether it’s helpful blogs with tips that can guide you through the process, to the facilitation of the journey by mortgage brokers in Annapolis, there are plenty of options to explore. However, using a free mortgage calculator can be an excellent, quick way to understand what kind of mortgage loan you can afford. You’ve probably seen this tool advertised, but may wonder what information is factored in, and what this information can tell you about your mortgage prospects. Let’s take a look at that.

What is the Purpose of a Mortgage Calculator?

At first, the answer to this question seems rather obvious, right? It’s a tool that helps you predict what mortgage payments might look like based on a variety of information. However, it’s perhaps more useful to define what a mortgage calculator is not. A mortgage calculator is not a guarantee of a rate from a lending company, and it is not a legitimate way to communicate to a seller what you can afford. Rather, it’s a tool for your to utilize internally, and help you make an educated decision as to whether or not you’re financially ready to take on a mortgage. Mortgages come with a lot of responsibility, and a calculator is a valuable tool in helping you decide if you should take the first step towards working with mortgage brokers in Annapolis.

What Information Is Calculated?

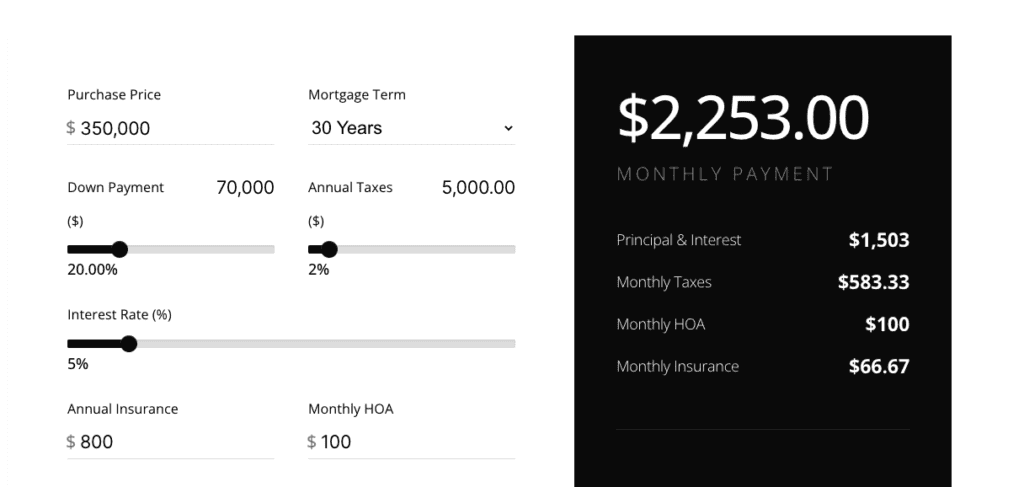

Different calculators have their own inputs. Some have more estimating tools while others are more limited. We’ll take a look at the mortgage calculator offered by Federal Hill Mortgage to break down what information an effective mortgage calculator should have.

A competent mortgage calculator should have a few different crucial elements. Let’s run through them.

Purchase Price

This is the total amount the home costs when you purchase it. When estimating this price based on similar properties you’ve looked at, it’s important to estimate somewhat higher in case you have to outbid a fellow buyer. This is especially recommended in highly competitive housing markets.

Mortgage Term

This refers to the length of time you will be paying off your mortgage. Most borrowers choose 30-year mortgages, though there are scenarios where shorter terms such as 15-year mortgages may be preferable. While rates may fluctuate depending on your mortgage choice, your term is almost always set unless you manage to pay off the mortgage early.

Down Payment

The amount that you’ll be putting down on the house, as represented by a percentage of the total cost. For borrowers seeking conventional loans, a down payment of 20% of the home’s price is usually required. Government-backed loan programs offer buyers the opportunity to put less down, as little as 3.5% for FHA loans and nothing down for VA loans. However, they also come with their own requirements, such as specific home prices, property locations, or veteran status.

Annual Taxes

Annual taxes refer to all the taxes you pay within a year associated with the property. Taxes can range based off state, county, and local municipalities. For instance, a house in Annapolis, MD worth $550,000 will come with an annual tax rate of $4,785. If you want to figure out the property taxes in your area, check out this useful location tax calculator.

Interest Rate

This will be one of the most important criteria that factor into your total monthly payments. Interest rates vary by loan type, loan period, and your qualifications as a borrower. Borrowers with better credit and higher income are typically afforded better mortgage rates. Loans with longer periods also tend to bring monthly payments down. Typically, your interest rate will remain the same unless you have an adjustable-rate mortgage. In this case, your mortgage rate will fluctuate over certain periods of time to match the market rate.

Annual Insurance

As mortgage brokers in Annapolis, we find that many buyers forget to factor in annual insurance expenses. While not as significant as annual taxes, annual insurance is still an important element you need to account for. Again, insurance will range based on the home’s location, price, and other extenuating factors.

Monthly HOA

Lastly, you’ll want to incorporate your monthly HOA dues. Not all homeowners will have to pay HOA dues, as only certain neighborhoods will have HOAs. Be sure to check on HOA regulations in your neighborhood when you’re choosing which home to purchase.

Free mortgage calculators are a useful tool to help you decide if you’re ready to shop for homes. But to take the true next step, you need to enlist the help of mortgage brokers in Annapolis. The team at Federal Hill Mortgage has an expert team here to help you make your home buying dreams come true. Apply today to get started.