As the mortgage landscape continues to evolve, staying informed on current trends can give homebuyers a critical edge. With 2024 shaping up to be a dynamic year for the housing market, understanding the key factors affecting mortgage rates, loan products, and home affordability is more important than ever. Below, we explore the top 10 mortgage trends for 2024 and what they mean for homebuyers and homeowners.

Interest Rate Fluctuations: Stability, but with a Catch

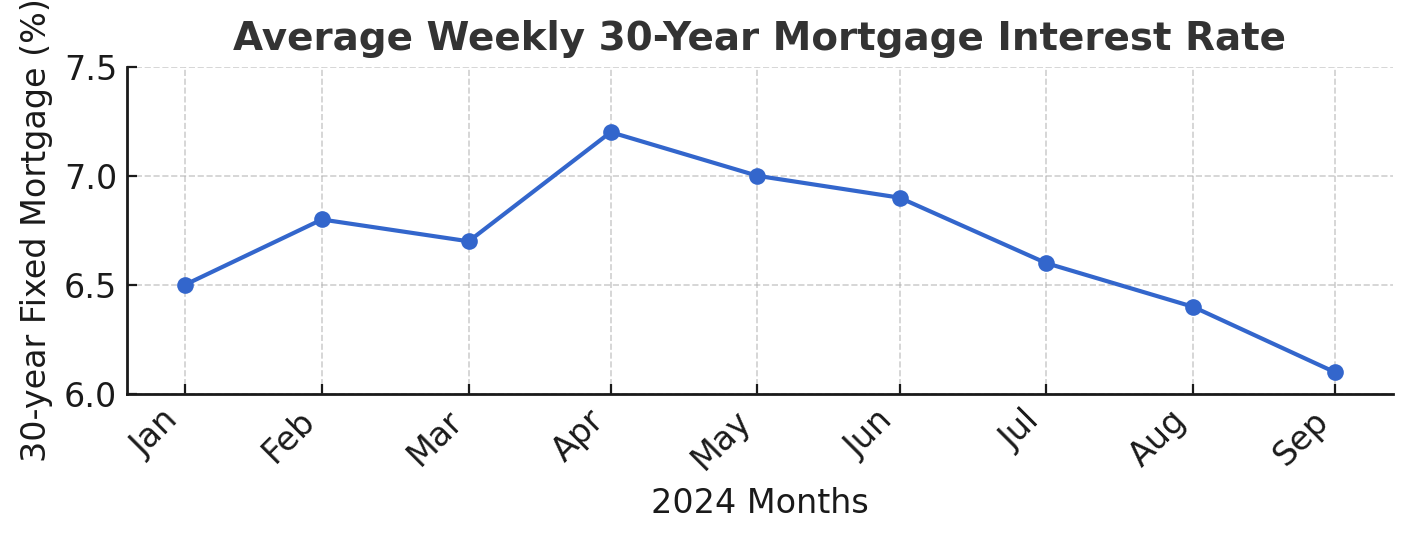

After a period of sharp rate increases, mortgage rates are finally stabilizing. While current rates average around 6.09% for a 30-year fixed mortgage, don’t expect major drops soon. The Federal Reserve’s recent rate cuts have already been factored into the market, which means any further changes will be slow and incremental.

What This Means for You

If you’re considering locking in a rate, now might be a good time. Waiting for rates to drop significantly could leave you disappointed. A small dip, like a 0.25% decrease, could still save you thousands over the life of a loan.

Action Tip: Talk to your lender about rate lock options. A short-term rate lock can help you secure a lower rate without the risk of waiting too long.

Personalized Mortgage Guidance Is Key

While technology can help streamline some aspects of the mortgage process, nothing replaces the value of a personalized approach. Many buyers find that working directly with a knowledgeable mortgage broker leads to a better understanding of their options and a more tailored solution. At Federal Hill Mortgage, we prioritize one-on-one guidance to ensure our clients make informed decisions every step of the way.

How This Benefits You

Unlike impersonal online platforms, we take the time to get to know your unique financial situation and homeownership goals. Our team works closely with you to find the best loan products, explain complex terms, and advocate on your behalf.

Pro Tip: When choosing a mortgage lender, look for one that offers personalized service and local market expertise—like we do at Federal Hill Mortgage.

Limited Housing Inventory: The “Mortgage Lock-In” Effect

Homeowners with ultra-low rates (under 4%) are hesitant to sell, leading to a tight housing supply. With fewer homes on the market, prices are staying high—currently averaging $422,600 nationwide

What You Should Do

If you’re buying, be prepared to move quickly when you find the right property. Consider expanding your search radius or looking at fixer-uppers to find more options.

Action Tip: Work with an experienced real estate agent who can alert you to new listings quickly and help you navigate bidding wars.

Adjustable-Rate Mortgages (ARMs) Are Making a Comeback

With rising home prices, more buyers are considering ARMs to secure lower initial payments. These mortgages have rates that can change over time, making them a riskier choice if you plan to stay in your home long-term.

Is an ARM Right for You?

An ARM might work if you’re planning to move or refinance within a few years. Otherwise, consider a fixed-rate mortgage to avoid potential rate hikes.

Action Tip: Always understand the terms of your ARM—know exactly when and by how much your rate could increase.

More Options for Self-Employed Borrowers

Traditional mortgage products often rely heavily on consistent W-2 income. However, lenders are increasingly offering bank statement loans and other alternatives for self-employed buyers.

Who Benefits from This?

If you’re a freelancer, consultant, or business owner, these products can be a game-changer. They allow you to use bank statements or assets to qualify instead of traditional income verification.

Pro Tip: Check with lenders specializing in non-traditional mortgage products to find the best fit for your financial profile.

Jumbo Loans Gaining Popularity as Home Prices Soar

With home prices continuing to rise, many buyers need jumbo loans—mortgages that exceed conventional loan limits. These loans typically have stricter requirements, but lenders are offering more competitive rates than in previous years

What You Need to Know

Jumbo loans are ideal for high-value properties but require strong credit and a substantial down payment. Make sure you shop around, as requirements can vary significantly between lenders.

Action Tip: Before applying, aim to have a credit score of at least 700 and a down payment of 20% or more for the best terms.

Down Payment Assistance Programs: Easier Access for First-Time Buyers

With housing affordability at a low, many state and local programs are expanding down payment assistance options. These programs help reduce upfront costs, making homeownership accessible for more buyers.

Action Tip: Research local assistance programs and speak with a mortgage advisor to see what you qualify for.

Refinancing Isn’t for Everyone—But It Might Be for You

With rates still relatively high, refinancing has slowed, but some homeowners are still choosing to refinance to cash out equity or switch from ARMs to fixed-rate loans.

When Does Refinancing Make Sense?

Consider refinancing if you can lower your rate by 0.5% or more, or if you need to convert an ARM to a fixed-rate product to stabilize your payments.

Pro Tip: Calculate the break-even point before refinancing to ensure the savings outweigh the closing costs.

Credit Scores Matter More Than Ever

As lending standards tighten, a strong credit score is crucial for getting the best mortgage rates. Lenders are even looking at alternative credit data like rental and utility payments.

How to Improve Your Score Quickly

Pay down credit card balances, avoid opening new credit lines, and make sure to pay all bills on time. Even a small boost in your score can save you thousands.

Action Tip: If your score is below 700, consider waiting a few months to improve it before applying for a loan.

Market Uncertainty Will Keep Rates in Check

While rates are expected to decline slightly, many factors could influence the direction of the mortgage market—such as inflation, unemployment rates, and even unexpected global events.

What Should You Do?

Stay informed and flexible. If you’re not in a hurry, keep an eye on the market for favorable opportunities.

Final Tip: Consult with a mortgage advisor regularly to reassess your options and take advantage of dips in the market.

Take Control of Your Mortgage Journey Today.

Need Help Navigating 2024’s Mortgage Market?

Connect with a mortgage expert at Federal Hill Mortgage for tailored advice and strategies to help you secure the best possible loan. We’re here to guide you through every step of the process.

Start My Application