Down payments are often viewed as one of the biggest barriers to entry for prospective buyers. Even if you can afford monthly mortgage payments, the idea of putting 20% down a loan worth several hundred thousand dollars. Fortunately, there are a variety of down payment options that can help make this process more tenable, from assistance programs to loan types that require very little down. Today, we’ll look at some of the local down payment options available typically available from a mortgage company in Towson.

Conventional Mortgage

To get a clear understanding of how down payments can scale, let’s start with the typically recommended rate of 20%.

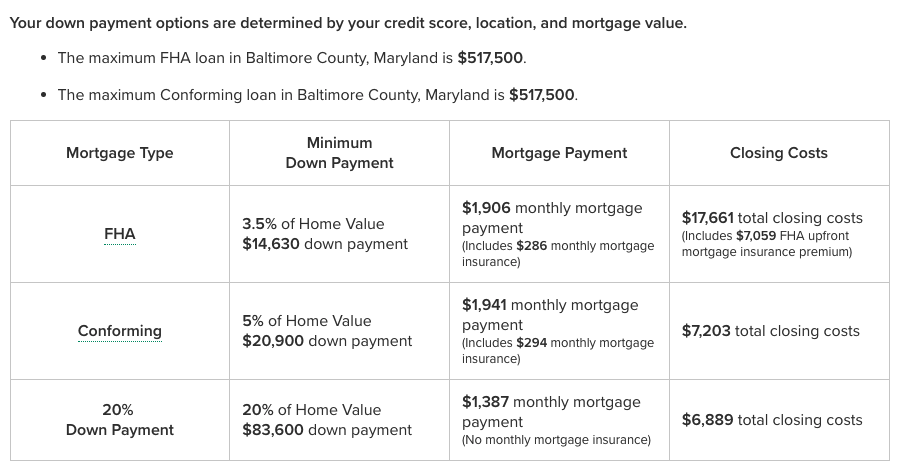

The average home cost in Townson is currently $418,000. For a 20% down payment with a credit score of at least very good (720-739), you would have to save up and pay down $83,600. As you can see, this has both its advantages and disadvantages. That is a lot to save up for many prospective homeowners, but alternatively, it will confer lower monthly payments, and usually means that requirements for mortgage insurance are dropped. If you can afford a 20% down payment, it’s usually recommended to pursue this route. However, it is important to know that there are other down payment options you can seek from your mortgage company in Towson.

Non-Conventional Loans

The first place to look for alternative down payment options within the realm of non-conventional loans. This term refers to loans that are insured by the federal government. Each non-conventional loan has its own requirements a prospective borrower must meet. Let’s take a look at some of the options most applicable to prospective buyers in the Towson area.

FHA Loan

FHA loans are backed by the Federal Housing Administration. Its purpose is to make home-buying more accessible to more people by reducing credit score requirements and the down payment needed. FHA loans can come with down payments as low as 3.5%. To qualify, you need a minimum credit score of 580.

VA Loans

VA loans are backed by the US Department of Veterans Affairs. To be eligible, you must be an active member of the US Armed Forces, a veteran, or a qualifying surviving spouse. Typically, a credit score of at least 620 is required, though some lenders may accept lower scores. The advantage of a VA loan is that you may be able to access loans with no money down on your home. To begin applying, you must first obtain a valid Certificate of Eligibility from the VA.

USDA Loans

If you’re willing to look a little outside the Towson area, there are eligible regions where you could qualify for a USDA loan. Backed by the US Department of Agriculture, USDA loans are reserved for buyers looking to live in rural or less-populated suburban areas. Towson and surrounding communities like Timonium are ineligible due to their population, but if you’re willing to look in areas such as Monkton, Hereford, Glen Arm, Kingsville, and more, you could get a great USDA loan. To qualify, you must have a minimum credit score of 640, but USDA loans also allow you to put no money down. To find out if a property is eligible, you can utilize this tool.

There are a variety of options available to you to lower your down payment required from your mortgage company in Towson. In our next article, we discuss down payment assistance programs local to the Towson area and Baltimore County.

At Federal Hill Mortgage, we make it our goal to keep our clients as educated as possible about their options. We help you make the right decisions regarding your finances and allow you to secure the mortgage that’s perfect for you. To get started, apply now.