In today’s economic climate, the dream of homeownership might feel distant, especially with the weight of interest rates pressing down on potential buyers. But don’t let this dishearten you; there’s a key to unlocking the door to your new home without the stress of hefty monthly payments. Enter the 2-1 Buydown Program, a strategy designed to ease the burden and pave a smoother, more affordable path to owning your home.

What's a 2-1 Buydown?

Tammy Saul, the visionary president of Federal Hill Mortgage, brings this innovative solution into the spotlight. In a recent enlightening video, she breaks down the concept simply: a 2-1 Buydown is a unique structure applied to a standard 30-year fixed mortgage. Here’s the magic – for the initial two years, you benefit from significantly lower interest rates. This reduction translates into manageable monthly payments, providing breathing room until the next opportunity to refinance emerges.

How Does a 2-1 Buydown Work?

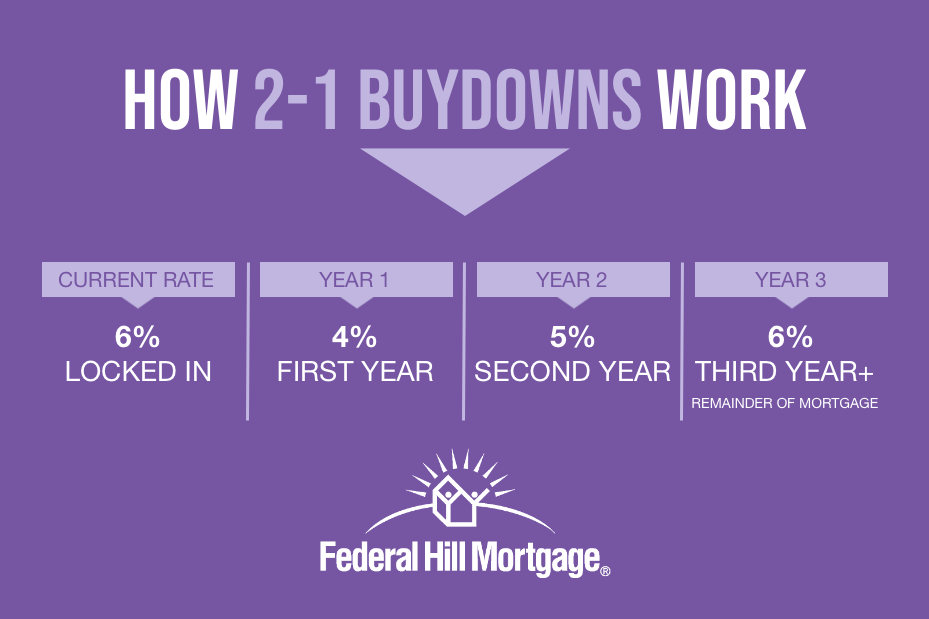

Imagine securing a mortgage at the current interest rate of, say, 6%. It sounds daunting, right? Here’s where the strategy shines. With a 2-1 Buydown, your interest rate—and consequently, your monthly financial commitment—drops to 4% in the first year and 5% in the second. It’s not until the third year that payments revert to the original rate, where they hold steady for the mortgage’s lifespan, unless you opt for refinancing.

Why Consider a 2-1 Buydown?

This approach isn’t just about immediate relief; it’s a long-term strategy. For buyers anticipating lower rates on the horizon, this program is a beacon of hope. It’s particularly advantageous because the seller covers the buydown cost, though this requires negotiation during the contract phase.

The 2-1 Buydown isn’t merely a temporary fix; it’s a proactive step towards financial comfort and certainty in your homeownership journey. It’s about making informed choices with lasting benefits.

Ready to Take the Next Step?

High interest rates shouldn’t be a barrier between you and your dream home. Let the experts at Federal Hill Mortgage guide you through the intricacies and advantages of the 2-1 Buydown program. Call us at 1-800-551-9198 to discuss your options with our dedicated loan partners. Your future home awaits, and it’s more affordable than you think!

Interested in purchasing a new home, but like the idea of easing into your mortgage payments?

Apply online today with Federal Hill Mortgage!

Apply Now