Investing in real estate can be a profitable venture, but securing the right financing is crucial. One option for real estate investors is the DSCR loan. This type of loan is particularly appealing because it focuses on the cash flow of the property rather than the borrower’s personal income. In this blog post, we will explore what DSCR loans are, how to qualify for them, their pros and cons, and much more.

What is a DSCR Loan?

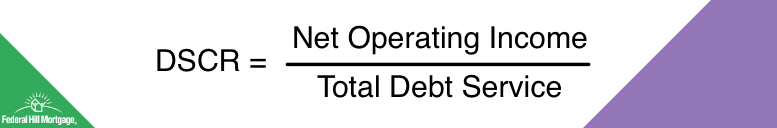

A DSCR (Debt Service Coverage Ratio) loan is a type of financing used by real estate investors to fund income-generating properties. Unlike traditional loans that rely heavily on the borrower’s personal income and credit score, DSCR loans evaluate the property’s ability to generate enough cash flow to cover its debt obligations. The key metric here is the Debt Service Coverage Ratio (DSCR), which is calculated by dividing the property’s net operating income (NOI) by its total debt service (the total amount of debt payments).

How Do You Qualify for a DSCR Loan?

Qualifying for a DSCR loan involves meeting several criteria:

- DSCR Ratio: Most lenders require a DSCR of at least 1.2, meaning the property’s income should be 1.2 times its debt obligations.

- Credit Score: A minimum FICO score of 640 is typically required.

- Down Payment: Expect to make a down payment of 20-25%.

- Property Income: The property must generate sufficient rental income to cover the loan payments.

Pros and Cons of DSCR Loans

Pros:

- Favorable Interest Rates: Competitive interest rates can lead to significant cost savings.

- Flexible Repayment Terms: Terms can be tailored to the borrower’s needs.

- Enhanced Borrowing Capacity: Higher DSCR can qualify for larger loan amounts.

- Long-Term Financing: Extended loan terms reduce monthly financial strain.

- Tax Benefits: Interest on DSCR loans may be tax-deductible.

Cons:

- Stringent Eligibility Requirements: High DSCR and other criteria can be challenging to meet.

- Collateral Risk: Lenders may seize the property if the borrower defaults.

- Prepayment Penalties: Some loans have penalties for early repayment.

- Interest Rate Variability: Rates can fluctuate with the market.

- Complex Application Process: Detailed financial assessments are required.

What Types of Properties Can Be Financed with a DSCR Loan?

DSCR loans can be used to finance a variety of income-generating properties, including:

- Residential properties up to four units (e.g., single-family homes, duplexes, triplexes, and fourplexes)

- Non-warrantable condos (limited to 75% LTV)

- Short-term rental properties with a history of rental income

What is a Good DSCR Ratio?

A DSCR ratio of 1.25 or higher is generally considered good. This ratio indicates that the property generates 25% more income than is needed to cover its debt obligations, providing a buffer for unexpected expenses or vacancies.

Can DSCR Loans Be Used for Real Estate Investments?

Absolutely. DSCR loans are ideal for real estate investors because they focus on the property’s income rather than the borrower’s personal finances. This allows investors to scale their portfolios without affecting their personal credit.

Are Interest Rates for DSCR Loans Higher?

Interest rates for DSCR loans can be comparable to conventional loan rates, though they may vary depending on the lender and the borrower’s financial profile. Some lenders may offer competitive rates to attract real estate investors.

What Are the Typical Loan Terms for DSCR Loans?

Loan terms for DSCR loans can range from 10 to 25 years or more. Both adjustable-rate and fixed-rate options are available, with some lenders also offering interest-only terms.

Can You Close a DSCR Loan in an LLC?

Yes, DSCR loans allow borrowers to hold property titles in an LLC, keeping the loan off personal credit reports and providing liability protection.

What Documentation is Needed for a DSCR Loan?

Documentation requirements focus on the property’s financial performance:

- Detailed income and expense reports

- Rent rolls

- Property appraisal reports

- Lease agreements

- Minimal personal financial information is needed compared to traditional loans

DSCR loans offer a valuable financing option for real estate investors looking to expand their portfolios. By focusing on the property’s cash flow rather than the borrower’s personal income, these loans provide a flexible and scalable solution for investment properties. Whether you’re new to real estate investing or looking to grow your holdings, understanding DSCR loans can help you make informed decisions and secure the financing you need.

Discover the Benefits of DSCR Loans with Federal Hill Mortgage

Ready to Invest in Real Estate?

Unlock the potential of your real estate investments with a DSCR loan. Let Federal Hill Mortgage guide you through the process with expert advice and personalized solutions.

Get Started Today